Plus, a game-changing resource to help you build financial freedom starting now

If you’ve ever called yourself a “broke college kid,” you’re not alone—and it’s not your fault. Between tuition, textbooks, meal plans, and late-night pizza runs, most students never get a clear roadmap for how to manage money in college.

But here’s the truth: you don’t have to stay broke. In fact, learning just a few key money skills now can set you up for a life of financial independence later.

Let’s walk through five simple but powerful ways to stop living paycheck to paycheck—and stick around to discover one of the best new financial resources made just for you.

1. Understand Where Your Money Actually Goes

Most college students don’t budget because they think they don’t have “enough” money. But a budget isn’t about how much you have—it’s about knowing where it’s going.

Start by tracking your spending for two weeks. Use apps like Mint, Goodbudget, or even just your phone’s notes. Then categorize your spending: food, entertainment, transportation, etc.

Quick Tip: You’ll probably find $50–$100/month you could redirect toward savings or paying off debt.

2. Differentiate Needs from Wants

That daily iced coffee or new pair of sneakers? They feel necessary, but they may be draining your future wealth.

Ask yourself: Is this helping me live, learn, or level up?

If not, it might be time to cut back—not forever, just while you’re building.

3. Learn the Language of Money

APR. Interest rates. Credit scores. These terms confuse a lot of students—and that’s by design. But if you understand them, you take back control.

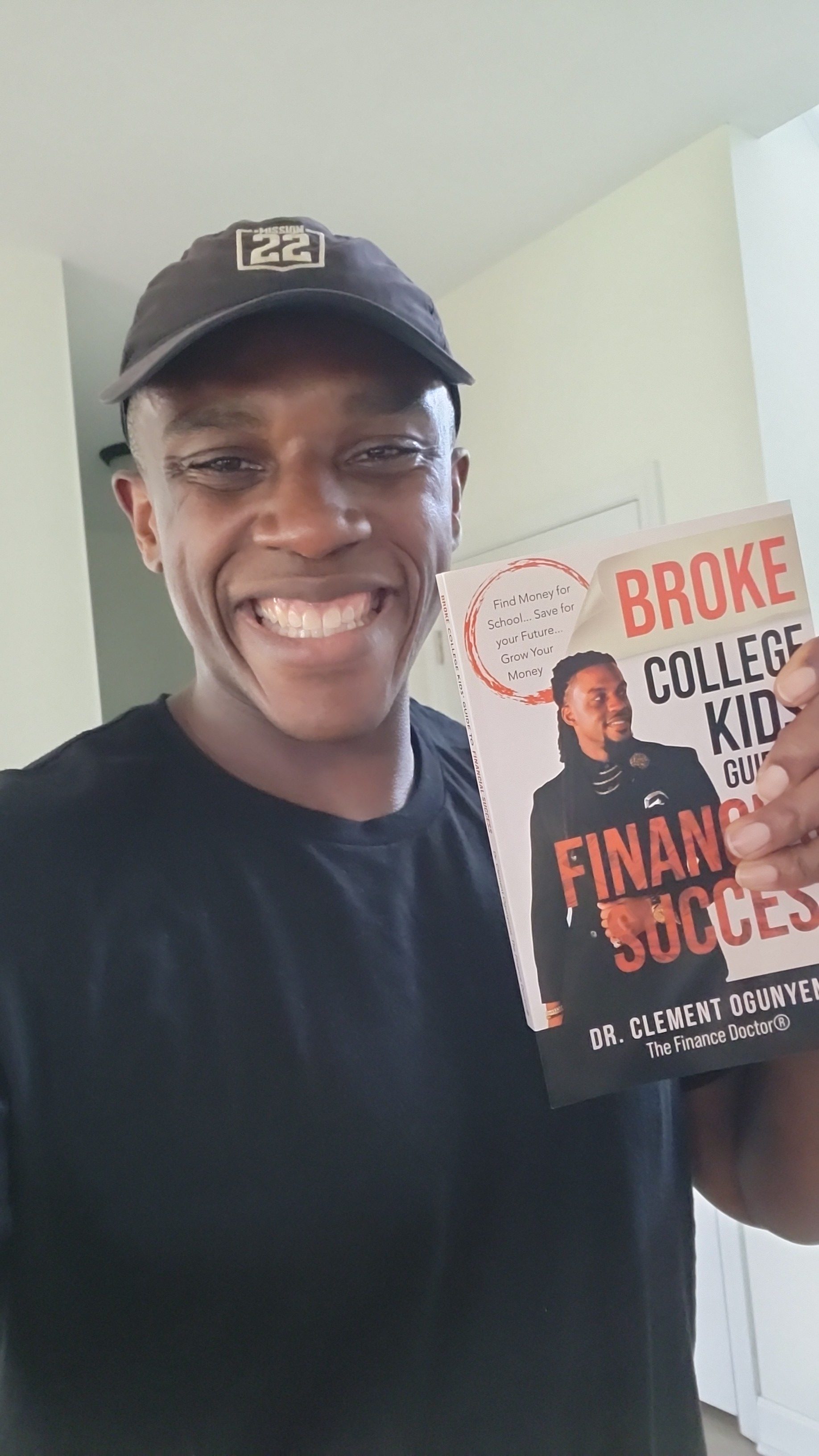

That’s exactly why my brother, Dr. Clement Ogunyemi (The Finance Doctor), wrote Broke College Kids Guide to Financial Success. He breaks down these confusing financial terms into real, relatable language that actually makes sense.

From budgeting hacks to building credit, his guide walks you through everything you need to know to stop feeling lost and start making smart money moves—without the jargon.

4. Use “Found” Money Wisely

Whether it’s birthday cash, a refund check, or your first part-time paycheck, don’t blow your “bonus” income.

Instead:

- Pay off small debt

- Build a $500 emergency fund

- Invest in resources that build your future (like the book below!)

Small decisions now = big freedom later.

5. Invest in Your Financial Education Early

The most successful people aren’t always the smartest—they’re the most prepared. And in today’s world, financial literacy is power. That’s why is important to learn how to manage money in college early.

That’s why I highly recommend pre-ordering Broke College Kids Guide to Financial Success.

This isn’t just a book—it’s a blueprint to:

✅ Stop living paycheck to paycheck.

✅ Understand your money.

✅ Build a solid foundation for real wealth and independence.

The best part? Every pre-order ships on Juneteenth (June 19th)—a day symbolic of freedom and ownership. There’s no better time to claim control of your finances.

Ready to Stop Being Broke? Start Here.

If you’ve ever said:

“I wish I learned this in school.”

“I don’t know how credit works.”

“I’m tired of living broke…”

…this is your moment.

Pre-order Broke College Kids Guide to Financial Success today.

Ships on June 19th—perfect timing to start summer with a new money mindset.

https://clementogunyemi.com/product/broke-college-kids-guide-to-financial-success/

Key Takeaways

- You don’t need a six-figure job to manage money well—you need a plan.

- Understanding basic financial concepts early gives you a huge advantage.

- Broke College Kids Guide to Financial Success is a no-fluff, high-impact resource that can change your life.

Leave a ReplyCancel reply